First quarter 2024 results: activity down compared to Q1 2023 as expected, gradual recovery in line with the outlook presented in the full-year results

HIGHLIGHTS

- Revenue down to €836 million in Q1 2024, or -20.5% compared to Q1 2023 (-12.7% at constant scope and exchange rates)[1]

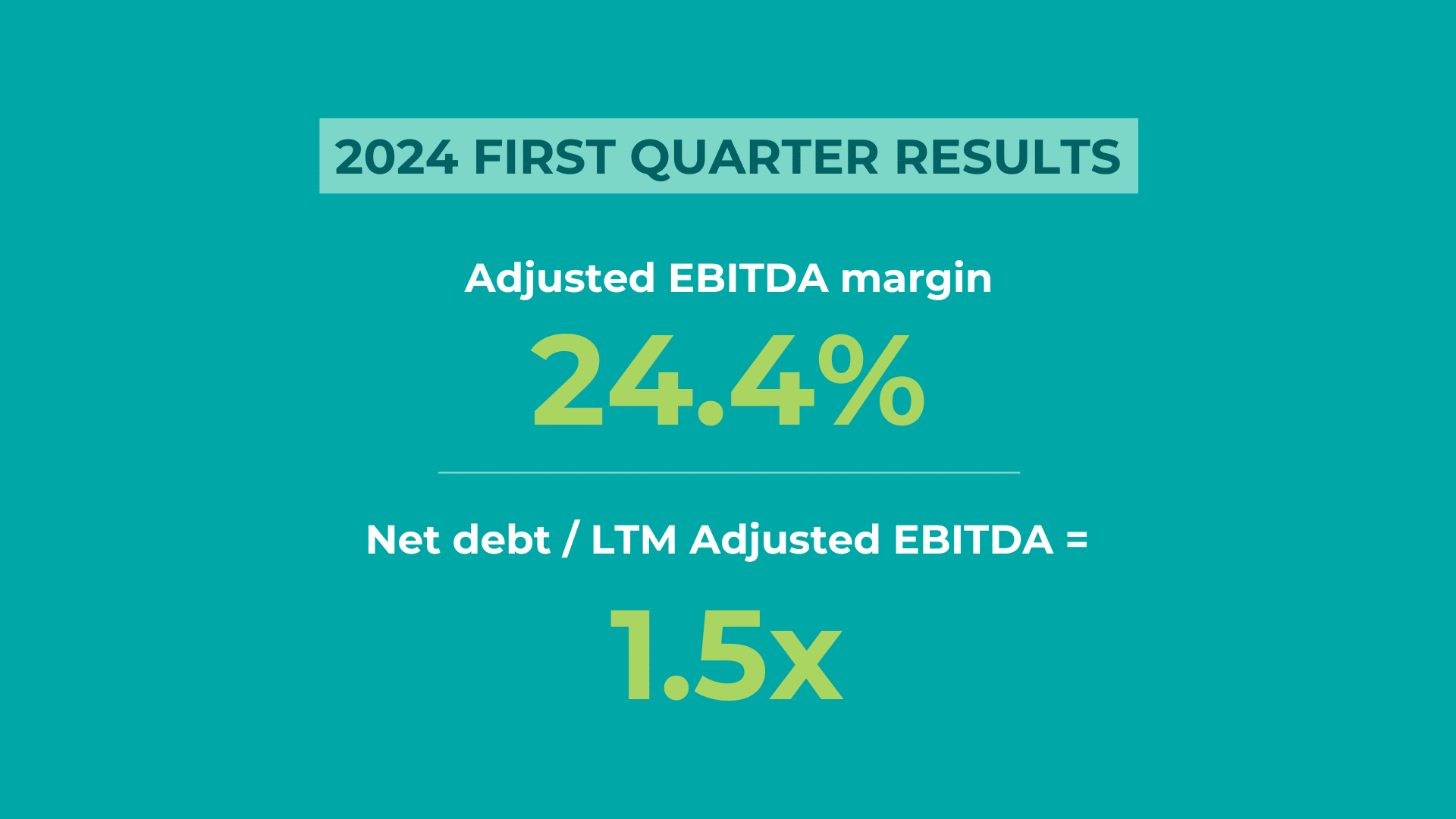

- Adjusted EBITDA[2] at €204 million (24.4% margin) from €307 million in Q1 2023 (29.2% margin)

- Strong net debt ratio maintained at 1.5x last 12-month adjusted EBITDA, compared to 1.3x at March 31, 2023 and 1.2x at December 31, 2023

- Awaiting regulatory approval for the acquisition of Vidrala’s Italian glass business for an enterprise value of €230 million

- Start-up of the 100% electric furnace in Cognac, a world premiere that will reduce CO2 emissions by 60%

- Confirming guidance of an adjusted EBITDA of around €1 billion in 2024

“Verallia started the year in line with expectations, with lower activity and prices compared to Q1 2023 which set a high basis of comparison. As expected, we are seeing encouraging signs of recovery from the Q4 2023 low. The continued commitment of our teams and the impact of the Performance Action Plan have enabled us to post a sequentially improving performance in the current market context. We confirm our guidance of an adjusted EBITDA of around €1 billion in 2024, with performance gradually improving over the course of the year. We are also pursuing our targeted external growth policy with the signing at the end of February of an agreement to acquire Vidrala’s glass activities in Italy,” commented Patrice Lucas, Chief Executive Officer of Verallia.

[1] Revenue growth at constant scope and exchange rates. Revenue growth at constant exchange rates is calculated by applying the same exchange rates to the financial indicators presented for the two periods being compared (by applying the exchange rates of the previous period to the financial indicators for the current period). Growth in revenue at constant scope and exchange rates excluding Argentina was -20.7% in the first quarter of 2024 compared to the first quarter of 2023.

[2] Adjusted EBITDA is calculated based on operating profit adjusted for depreciation, amortisation and impairment, restructuring costs, acquisition and M&A costs, hyperinflationary effects, management share ownership plans, disposal-related effects and subsidiary contingencies, site closure costs, and other items.